Correct Answer

verified

11eb1113_30f0_f29b_b6c5_93dfb94a0ef3_TB2259_00

Correct Answer

verified

Multiple Choice

Melissa Taylor has gross earnings of $425 and withholdings of $26.35 for Social Security tax, $6.16 for Medicare tax, and $35 for federal income tax. Her employer pays $26.35 for Social Security tax, $6.16 for Medicare tax, $3 for FUTA tax, and $9 for SUTA tax. The total cost of Melissa to her employer is

A) $32.51.

B) $425.00.

C) $469.51.

D) $437.00.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the terms with the definitions. -Employer's Quarterly Federal Tax Return

A) Electronic Federal Tax Payment System (EFTPS)

B) employer FICA taxes

C) Employer Identification Number (EIN)

D) Form W-2

E) Form W-3

F) Form 940

G) Form 941

H) FUTA (Federal Unemployment Tax Act) tax

I) merit-rating system

J) self-employment income

K) self-employment tax

L) SUTA (state unemployment tax) tax

M) workers' compensation insurance

O) A) and F)

Correct Answer

verified

Correct Answer

verified

True/False

Self-employment income is the gross income of a trade or business run by an individual.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

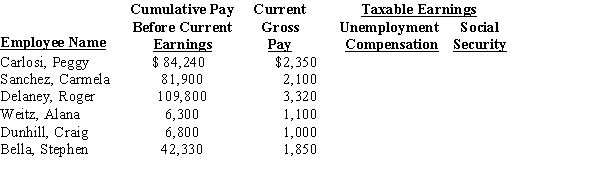

Selected information from the payroll register of Barbara's Stables for the week ended September 28, 20--, is as follows: Social Security tax is 6.2% on the first $110,100 of earnings for each employee. Medicare tax is 1.45% of gross earnings, FUTA tax is 0.8%, and SUTA tax is 5.4% each on the first $7,000 of earnings.

Calculate the amount of taxable earnings for unemployment and Social Security taxes, and prepare the journal entry to record the employer's payroll taxes as of September 28, 20--.

Calculate the amount of taxable earnings for unemployment and Social Security taxes, and prepare the journal entry to record the employer's payroll taxes as of September 28, 20--.

Correct Answer

verified

Correct Answer

verified

True/False

The employer must pay the amount owed for Social Security and Medicare by the business to the IRS; however, the employees pay for Social Security and Medicare directly to the IRS.

B) False

Correct Answer

verified

Correct Answer

verified

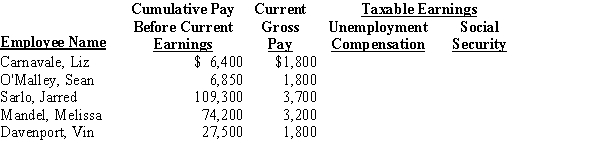

Essay

From the following information from the payroll register of Veronica's Auto Supply Store, calculate the amount of taxable earnings for unemployment and FICA tax, and prepare the journal entry to record the employer's payroll taxes as of April 30, 20--. Social Security tax is 6.2% on the first $94,200 of earnings for each employee. Medicare tax is 1.45% of gross earnings. FUTA tax is 0.8%, and SUTA tax is 5.4% each on the first $7,000 of earnings.

Correct Answer

verified

Correct Answer

verified

True/False

FUTA taxes are deposited and an annual report of federal unemployment tax is filed using Form 8109.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The FUTA tax applies to all employee earnings throughout the year.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If an employer qualifies for a lower state unemployment tax rate, this lowers the credit allowed in computing the federal unemployment tax due.

B) False

Correct Answer

verified

False

Correct Answer

verified

True/False

Employees usually pay the entire cost of workers' compensation insurance.

B) False

Correct Answer

verified

False

Correct Answer

verified

Multiple Choice

To journalize the employer's payroll taxes, we need to credit all of the following accounts EXCEPT

A) Payroll Taxes Expense.

B) Social Security Tax Payable.

C) Medicare Tax Payable.

D) FUTA Tax Payable.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Form 941 is a(n)

A) Employee Withholding Allowance Certificate.

B) Employer's Quarterly Federal Tax Return.

C) Wage and Tax Statement.

D) Employer's Annual Federal Unemployment Tax Return.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A self-employment tax is required of an individual who owns his or her own business and makes

A) $1 or more.

B) $200 or more.

C) $400 or more.

D) $1,000 or more.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The due date for payroll taxes is not the same date for all employers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the terms with the definitions. -A contribution to the FICA program.

A) Electronic Federal Tax Payment System (EFTPS)

B) employer FICA taxes

C) Employer Identification Number (EIN)

D) Form W-2

E) Form W-3

F) Form 940

G) Form 941

H) FUTA (Federal Unemployment Tax Act) tax

I) merit-rating system

J) self-employment income

K) self-employment tax

L) SUTA (state unemployment tax) tax

M) workers' compensation insurance

O) I) and K)

Correct Answer

verified

Correct Answer

verified

True/False

By January 31 each year, employers must furnish each employee with a Wage and Tax Statement.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The employer pays which of the following to the Internal Revenue Service?

A) the employer's Social Security and Medicare taxes

B) sales taxes

C) property taxes

D) no taxes

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Self-employment tax is double the Social Security and Medicare rates.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A key source of information for computing employer payroll taxes is the

A) statement of owner's equity.

B) end-of-period balance sheet.

C) payroll register.

D) employees' check stubs.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 79

Related Exams